Unlocking $225 Billion From Retail Inventory | How Structured Trade Solutions Are Reinventing Strategies and Building Supply Chain Resilience

A recent EY analysis revealed that retailers may be sitting on billions of dollars in trapped cash, with an opportunity to release $225 billion from balance sheets with the help of improved inventory and supply chain management strategies.

Inflation, coupled with geopolitical shifts has negatively impacted consumer discretionary spending, leading to lower than anticipated demand and high inventory in various segments. With a constant need to innovate and invest, improving working capital and cash flow has now become a necessary strategy.

Structured Trade Solutions emerge critical as retail firms contend with these uncertainties, helping them optimise their working capital cycles, enhances their supply chain resilience and unlock liquidity through suitable financial structures.

Understanding the Global Retail Industry Landscape

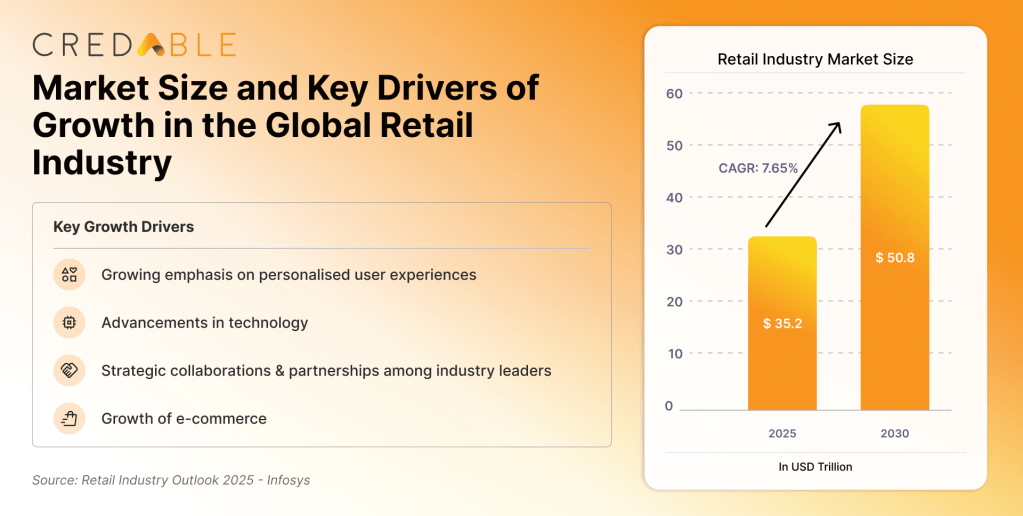

The global retail industry represents one of the world's largest economic sectors, with massive scale and a continuous growth trajectory despite facing significant operational challenges. The retail market is projected to reach $35.2 trillion in 2025, expanding at a compound annual growth rate (CAGR) of 7.65%, reaching approximately $50.8 trillion by 2030.

That said, over the last few years, consumer demands have been weak, leading to subdued growth in retail sales. With the forecast for global economic growth five years from now, projected at 3.1%, the lowest in decades, retailers will likely face continuing weak demand. The volatile economic environment makes profitability a goal that requires complex strategic planning. Operational efficiency in retail would require a comprehensive approach to optimising inventory and supply chain management to control costs and enhance overall performance.

Problems that Riddle the Retail Sector Across the Globe

The global retail sector grapples with persistent working capital and inventory challenges. The shock of unexpected disruptions (wars, pandemics, geopolitical shifts) and a realisation that supply chains were previously quite fragile has intensified efforts to build more resilient and diversified supply chains.

- With global economic growth at its lowest in decades and shopping behaviours reverting to pre-pandemic norms, retailers are facing a build-up of large volumes of unsold inventory, locking up working capital and exerting pressure on margins.

- Tariff policies remain in constant flux, and for retailers this can mean cost volatility, pricing uncertainty, and shifts in consumer behaviour. The tariffs bring with itself an initial increase in prices, which dampen consumer spending and inventory levels.

- A recent consumer sentiment data revealed that 80% of shoppers are concerned about how the tariffs affect their finances, with 76% anticipating a change in their shopping habits.

These pressures converge at the inventory level, where inefficiencies deepen the financial strain on retailers.

Inventory Management Challenges in Retail

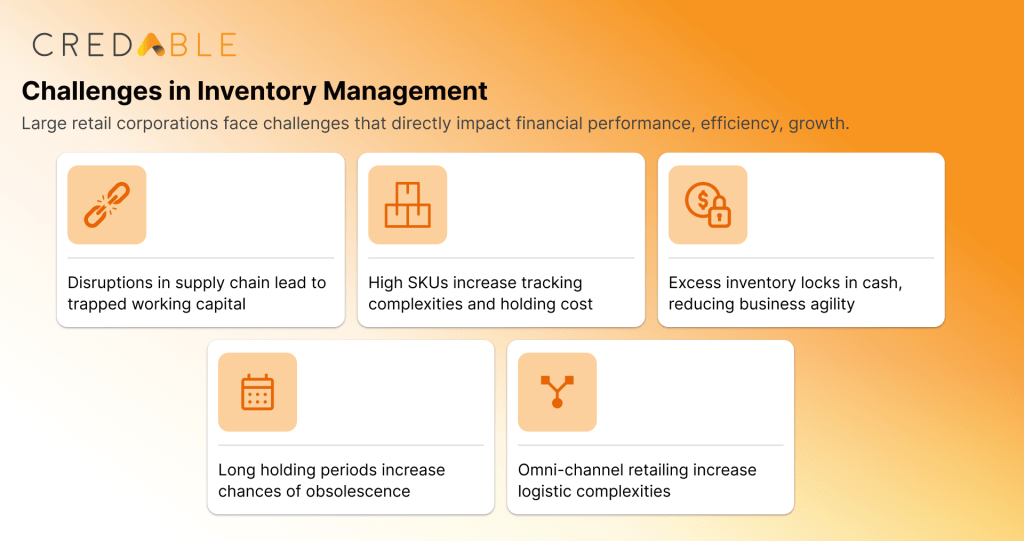

Large retail corporations face severe inventory management challenges that directly impact their financial performance and operational efficiency.

- Disruptions in supply chains due to geopolitical shifts often necessitates retailers to maintain excess inventory as a buffer, but this ties up significant working capital, reduces agility and limits investment in growth.

- The scale of operations amplifies complexity, with 62% of larger retailers report struggling with excess inventory. A high number of SKUs stored at multiple locations complicates tracking across geographies.

- Holding unsold stock for extended periods increases the likelihood of obsolescence which directly impacts gross margins.

- With omnichannel retailing and global sourcing, managing and redistributing excess stock across locations becomes logistically complex and calls for appropriate technology to manage the same.

The trapped cash in inventory has the potential to fund transformations and growth. This underscores the need for modern financing structures and strategies that are as adaptive and dynamic as the retail environment itself.

Re-imagining Retail Resilience with Structured Trade Solutions

Market volatility driven by geopolitical instability, economic uncertainty, and shifting consumer behaviour can disrupt even the most established supply chains. What the retail industry now needs is a shift towards adaptive capacity- balancing inventory and cost controls with flexibility and real-time visibility.

This makes structured trade solutions essential. For retailers with significant working capital locked in seasonal inventory peaks, these solutions provide a smarter way to manage liquidity and mitigate risk. By aligning financing with actual demand cycles, structured trade helps retailers across segments enhance cash flow, improve resilience, and unlock growth.

Structured Trade Solutions by CredAble

Structured Trade Solutions can help retail giants address their inventory challenges through strategies that help align inventory holding levels with actual demand patterns, ensuring liquidity and managing obsolescence.

Explore Structured Trade SolutionsTrade structures improve liquidity positions by optimising procurement cycles and extending credit periods. Our platform leverages advanced technology to streamline supply chain financing and trade intermediation. Through these solutions retailers can:

- Right-size inventory by aligning procurement to actual demand, reducing risk of obsolescence and markdowns.

- Unlock liquidity trapped in inventory by optimising procurement and extending credit cycles.

- Gain a real-time “eagle-eye” view of inventory movement and trade documentation through integrated ERP connections.

- The technology powers the management of thousands of SKUs across multiple geographies and scale with ease.

- Streamline fragmented networks through supplier aggregation, improving visibility, efficiency, and compliances.

- Help control holding costs by reducing reliance on suppliers for inventory holding.

In today’s dynamic retail environment, agility in financing is just as critical as agility in operations. Structured Trade Solutions empower retailers to build agile, future-ready supply chains.

Future-Proofing Retail Operations with Structured Trade Solutions

As global retailers battle margin pressures, supply chain volatility, and shifting consumer expectations, the need to innovation is clear. Structured Trade emerges as a strategic necessity, by embedding technology and advance financial structures into trade. With CredAble, retailers can manage liquidity proactively, right-size their inventory to suit demands, and future proof operations in the increasingly dynamic global markets.

In partnering with CredAble, retailers don’t just solve for today’s constraints, they build the financial and technological foundation for the retail enterprise of tomorrow.

Think Working Capital… Think CredAble!