The Strategic Role of Working Capital Financing in Future-Proofing Supply Chains for 2025

Over the last five years, supply chains have received unprecedented attention due to disruptions caused by the pandemic.

Not to mention economic realignments owing to heightening geopolitical tensions.

Case in point: A significant 60% of small and mid-sized businesses have suffered losses of up to 15% or more in revenue owing to supply chain disruptions.

Here's where it gets interesting—the way your business manages its working capital ties directly to its supply chain efficiency.

In this blog post, we unpack how rethinking supplier terms and payment cycles influences liquidity, helping you build a financial cushion for the unexpected.

Treating cash flow as an operational priority

Cash flow management has always been looked at as a tool for crisis mitigation.

This shouldn't be the case.

Considering cash flow as an operational priority shifts its role from a reactive measure to that of a strategic enabler.

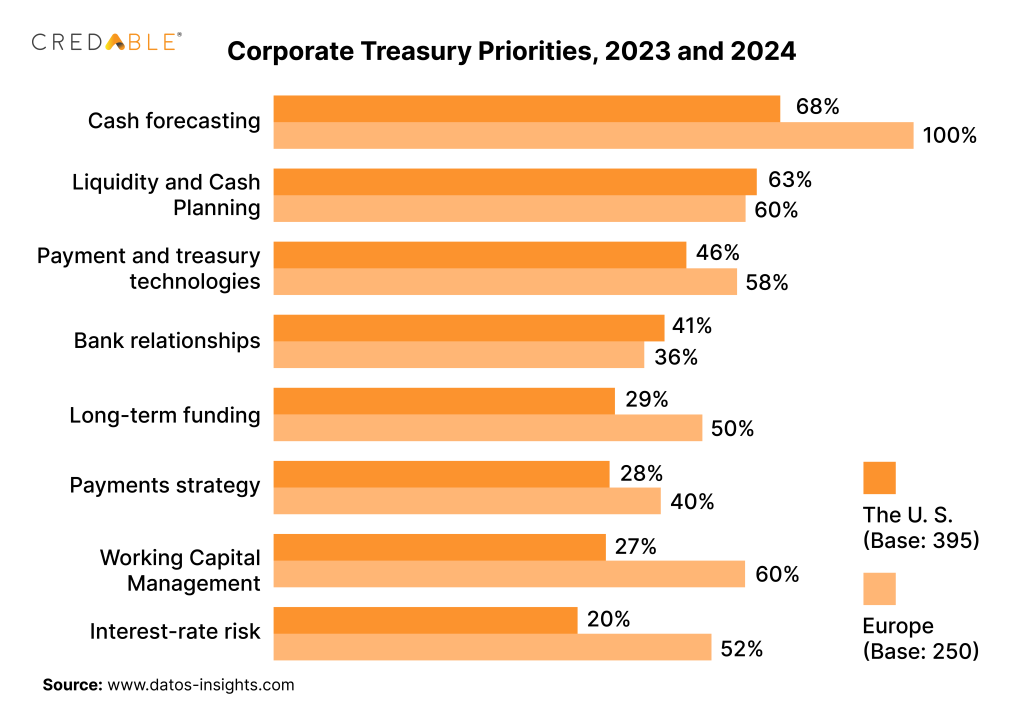

With cash forecasting topping the charts as a priority for corporate treasury teams, CFOs are turning the tide on volatility by aligning working capital strategies with broader operational goals.

By doing this, they are paving the way for faster and more accurate decisions on working capital needs.

As per Visa's recent report, 'The Growth Corporates Working Capital Index,' the use of working capital as a strategy rather than an emergency cash flow stopgap has seen a rise of 16% among growth corporates.

This approach has resulted in better anticipation of cash flow needs followed by year-over-year improvements in working capital ratios.

From a proactive stance, here are a few steps that businesses are taking in this direction:

- Investing in technology for better financial forecasting

- Consolidating and centralising financial and operational data for real-time insights

- Creating forecasts that account for variables like supply chain disruptions or payment delays

- Integrating cash flow considerations into procurement and payment processes

- Fostering collaboration between finance and supply chain teams

- Aligning procurement schedules with cash flow cycles

- Sharing financial insights across departments to support unified decision-making

Businesses today are partnering with FinTechs to develop real-time dashboards to monitor cash positions, have unified control over their receivables and payables, and pull up accurate cash flow forecasts.

By mapping out real-time cash requirements—these approaches help businesses plan the strategic use of surplus cash for high-impact areas like investments or cutting down debts.

Strengthening the supply chain with timely, flexible financing solutions

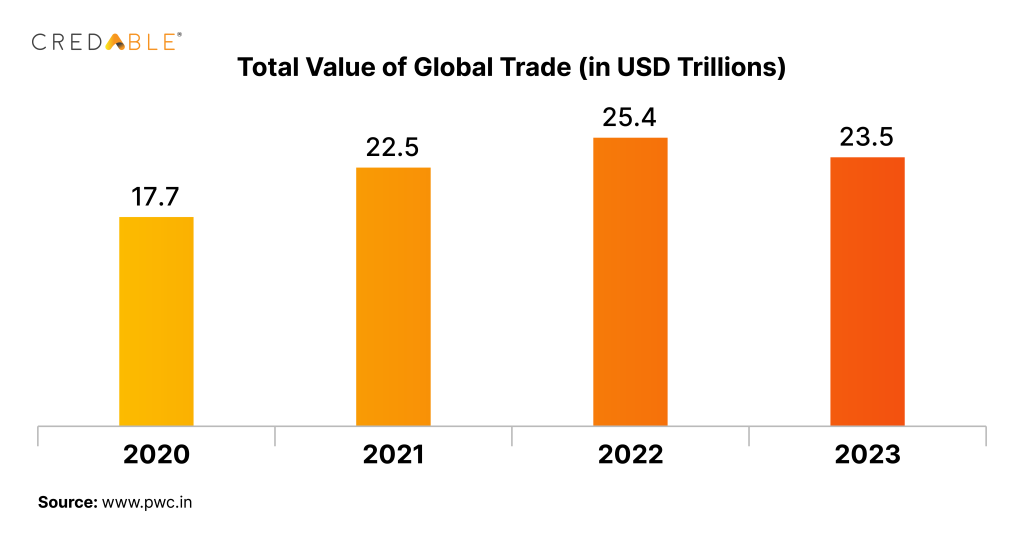

In recent times—global trade volumes are levelling up, reaching USD 23.5 trillion in 2023, bolstering international markets.

While the spike in trade volumes presents immense opportunities, it also creates challenges that call for a measured approach to working capital management.

As per a KPMG report, 47% of supply chain leaders acknowledge increased vulnerability to disruptions, which they plan to combat with a combination of advanced data analytics and tech-enabled working capital financing solutions.

Given the interconnectedness of supply chains, disruptions in one area can have a ripple impact through the system.

Against this background, striking a balance between managing payment terms and maintaining supplier trust requires careful planning.

For instance, sectors like manufacturing and construction often deal with significant upfront costs before revenues are realised. Prolonged payment terms can strain relationships with suppliers who need consistent cash inflow to maintain their inventory or services.

In such cases, it becomes imperative to establish transparent payment terms and maintain open communication channels to address payment concerns and strengthen supplier relations.

Extending payment terms might temporarily improve cash flow, but it can jeopardise supplier relationships, leading to delays and inefficiencies.

To address this, businesses are turning to flexible financing solutions like:

- Receivables financing: This provides suppliers access to immediate funds tied up in unpaid invoices without stressing their credit limits.

- Short-term loans: Businesses use short-term loans to cover immediate cash flow needs and meet payment deadlines.

- Optimising payment cycles: Payment terms with suppliers are strategically extended to align with cash flow forecasts while ensuring suppliers are not burdened.

- Just-in-Time (JIT) inventory financing: This anchor-led financing solution provides dealers the flexibility to scale inventory levels up or down based on market demand. JIT financing allows businesses to purchase stock exactly when needed, minimising unnecessary capital tied up in surplus inventory. Tech-enabled JIT financing provides real-time insights into inventory levels, improving forecasting accuracy and operational decision-making.

- Early payment incentives: By approaching FinTechs like CredAble, corporates can access funds to make early payments to suppliers in return for a discount.

For MSMEs, access to credit remains a significant challenge. Anchor-led supply chain financing allows them to sidestep traditional lending roadblocks, accessing affordable funds tied to their corporate buyers’ creditworthiness.

From innovative financing solutions to DPI-backed credit assessments and deep-tier SCF—businesses today have a range of tech-enabled financing solutions that work in tandem with buyers and suppliers.

The pivot to tech-driven working capital financing

Among market uncertainties like reshoring of supply chains, political uncertainties from elections, and the high costs of refinancing COVID-related debt—integrating working capital management with supply chain management will be crucial for organisations to optimise cash flow, respond better to market shifts, and fund strategic investments.

As sustainability pressures rise and investments in AI technology increase, businesses must adopt tech-driven solutions to optimise their cash flow and working capital strategies.

According to a latest industry report, emerging corporates are in search of a financial partner with “a deep understanding of their corporate and commercial banking needs.”

The next frontier in working capital financing

At CredAble, we are future-proofing working capital financing by integrating advanced AI and machine learning technologies into our solutions. Our data-driven platform enables real-time monitoring of invoice finance portfolios. We also leverage machine learning algorithms to detect early warning signals of potential payment delays or defaults.

This proactive risk management approach helps banks make data-backed decisions and respond quickly and proactively to emerging challenges. By integrating multiple data sources related to creditworthiness, we provide banks with accurate evaluations and targeted solutions for MSMEs and underserved sectors.

Further to accelerate time to revenue, we are not limiting AI to improving digital touchpoints; we are exploring opportunities to build AI-driven partner-specific business models that will help financial institutions roll out contextual solutions.

Our low-code Loan Origination and Management Systems simplify trade finance digitisation, offering ready-to-use plugins and active connectors that streamline workflows from onboarding to disbursement. We also collaborate with utility providers and leverage Digital Public Infrastructure (DPI) to create comprehensive financial ecosystems that enhance supply chain finance.

By continually evolving our solution suite, we ensure that we meet the growing demands of flexible, scalable working capital financing while future-proofing our offerings with cutting-edge technology.

Think Working Capital… Think CredAble!