Unlocking 2X Profitability with Smarter Inventory & Channel Financing Solutions

The ongoing geopolitical tensions have reminded the world of the fragility of global supply chains.

If you look at the numbers—47% of supply chain leaders have reported increased vulnerability to disruptions.

To top it off—recent economic shifts have brought with them higher shipping costs, significant supply shortages, and greater uncertainty.

Here’s what’s concerning—the dealers and distributors who form the backbone of the supply chain face unique challenges in balancing their working capital needs while managing unsold stock.

Given how inventory management directly impacts profitability levels—dealers need to manage stock levels strategically, preventing supply chain disruptions while preserving working capital for other priorities.

A closer look at the dealer dilemma

When corporates sell inventory to dealers, the expectation of timely payment often clashes with the reality of slow-moving stock.

Owing to this, dealers often find themselves in a bind—they need inventory to meet demand but lack the upfront capital to pay corporates immediately.

This creates a cash flow crunch that adversely impacts both the dealer's operational efficiency and the corporate's receivables.

Additional consequences for dealers include:

- Higher operational costs: Holding excess stock means dealing with higher warehousing and transportation expenses, not to mention obsolescence risks. Warehousing costs have risen by 14% year-over-year due to increased demand and limited supply.

- Balance sheet effects: Excess inventory also locks in capital, preventing businesses from investing in growth, innovation, and expansion.

Missed revenue opportunities often stem from poor inventory planning and visibility.

Overcoming the gap in upfront payments

To address this critical gap in the supply chain ecosystem, many companies are now turning to Fintechs for dealer financing (also known as channel financing). This innovative working capital solution backs channel partners like dealers and distributors for the purchase of goods or services from a corporate.

With a tech-driven channel financing solution, dealers can grow their business by increasing their stock levels or expanding into new markets with sufficient stock. On the other hand, corporates can manage their working capital effectively with timely payments and operate with a better understanding of their cash position.

While in the past, channel financing was an exclusive domain of banks and large credit institutions, we're noticing a significant shift. Traditional financial institutions often fail to bridge the gap due to their reliance on outdated credit assessment models and siloed platforms. Banks with their legacy systems miss out on the digital workflows and data-driven insights that are critical in evaluating dealer creditworthiness effectively.

Only 23% of MSME dealers have easy access to formal credit, leading to reliance on costly informal sources.

This is where FinTechs like CredAble are stepping in to offer credit cushions to corporates and their ecosystem of dealers, plugging the channel financing gaps with integrated solutions, best-in-class tech, and agile operating workflows.

Explore CredAble’s Dealer Financing SolutionsHow FinTechs are powering faster, upfront payments

FinTechs are taking a strong stand by providing Supply Chain Financing (SCF) solutions that support global supply chains. Backed by sophisticated risk assessment modules and need-based digital financing solutions, CredAble is uniquely positioned to offer a variety of SCF offerings tailored to unique channel financing needs.

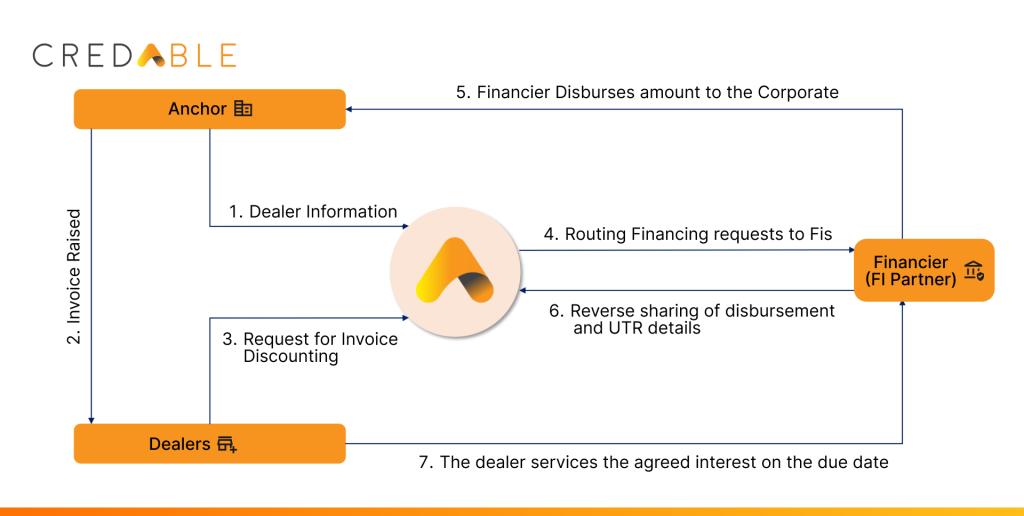

Here's a quick look at how CredAble's Dealer Financing Platform (DFX), a digital receivables acceleration solution, is creating a win-win scenario across supply chains worldwide:

- Integrated digital platform: CredAble brings corporates, dealers, and financiers onto a unified digital platform.

- Extra credit cushion for dealers: With DFX, dealers have the option to receive the credit to purchase inventory without needing to make immediate payments. This gives them the flexibility to sell the stock and generate revenue before settling dues.

- On-time payments for corporates: While dealers benefit from extended payment terms, the corporate receives funds upfront, ensuring cash flow stability.

- Data-driven credit assessment: Collaborating with corporates, CredAble evaluates dealer performance and creditworthiness, ensuring that only reliable dealers—capable of making repayments—receive financing.

- Repayment flow: Once the dealer sells the stock, payments are routed through CredAble to the financier, closing the loop seamlessly.

How CredAble's DFX platform ensured timely dealer payments for an FMCG conglomerate

A leading Electronics giant partnered with CredAble to address delayed payments from its dealers and distributors. Through CredAble's built-to-suit DFX platform, the company could extend timely credit lines to dealers. As a result, the dealers received inventory without immediate payment obligations, allowing them to focus on sales and not be limited by working capital that is tied up in unsold stock. The company received timely payments from CredAble's financier network, ensuring uninterrupted cash flow.

While the dealers benefitted from an extended credit period without disturbing corporate receivables cycles, the dealers eventually repaid the financier as they sold their stock.

CredAble's tech advantage helped the stakeholders in multiple ways:

1. With a fully digital platform, CredAble ensures smooth integration with client systems, centralising all stakeholders onto a single system, streamlining operations, and reducing gaps.

2. CredAble's credit assessment mechanisms utilise AI and machine learning models along with corporate inputs to identify dealers who are creditworthy of financing.

3. The platform provides full visibility on payments with an audit trail that allows all stakeholders to monitor cash flow efficiently.

4. The ready-to-scale programme maximises coverage of dealers and focuses on expanding coverage by bringing on board additional financiers.

The FinTech-led future of dealer financing

Due to rising inventory costs and increasing demand for integrated and interoperable solutions—dealer financing is poised for growth.

By aligning and catering to the interests of all stakeholders, FinTech-led dealer financing solutions are driving unmatched profitability and operational efficiencies, reimagining inventory management for modern supply chain networks.

Platforms like CredAble's DFX are bridging critical gaps—ensuring dealers have access to inventory while corporates experience cash flow stability.

CredAble is playing a broader role in the global trade finance ecosystem by advancing the frontiers of innovation and offering solutions that go beyond banking and traditional loan products. Utilising advanced machine learning algorithms and AI, CredAble is automating the end-to-end channel financing experience, offering corporates and their dealer ecosystem greater visibility and control over their inventory and finances—in turn, helping them make informed financial decisions about the business.

Think Working Capital… Think CredAble!