Inside the GCC’s $50 Billion Working Capital Shift: Reinventing Trade Finance with DPI

A $2.5 trillion Trade Finance funding gap continues to throttle businesses around the world. But in the Gulf, something different is happening. The Gulf Cooperation Council (GCC)—and more specifically, the United Arab Emirates and Saudi Arabia—isn’t just reacting to this crisis. It’s re-thinking how capital moves through global supply chains and B2B ecosystems.

What’s Shifting in GCC?

The region’s largest economies are quietly becoming magnets for working capital. UAE and Saudi Arabia are leading this pivot, underpinned by long-term economic blueprints, regulator-driven fintech reforms, and a bold bet on digital public infrastructure.

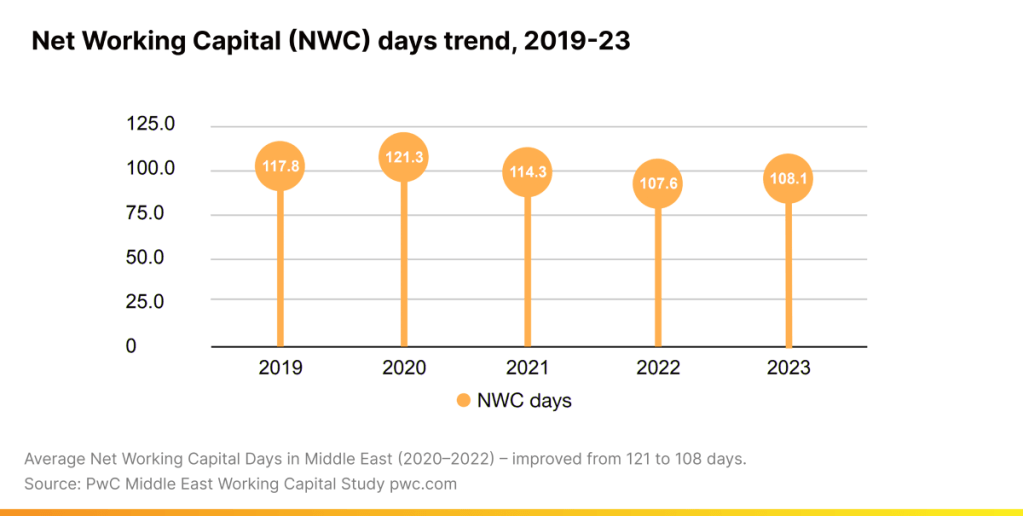

Between 2020 and 2022, average net working capital (NWC) days across Middle Eastern businesses dropped from 121 to 108. That’s not just operational efficiency—it’s $50 billion in liquidity that companies are now trying to put to work.

Average Net Working Capital Days in Middle East (2020–2022) – improved from 121 to 108 days.

Reduce your Working Capital DaysThe Liquidity Opportunity Hiding in Plain Sight

The below chart shows a steady decline in Net Working Capital (NWC) days across most GCC countries between 2019 and 2023 and while Saudi Arabia still holds the region’s longest NWC cycle, it’s improving.

The country recorded a 2-day year-on-year drop in DSO in 2023—part of a broader push by the government to unlock liquidity across its commercial and SME value chains.

Supply Chain Finance (SCF) fits in seamlessly here. It accelerates receivables, extends payables, and keeps suppliers liquid without straining buyers.

Location, Liquidity, Leverage

What makes the GCC different isn’t just ambition, but a broader focus on its trade finance infrastructure.

Sitting at the crossroads of Asia, Europe, and Africa, the region is poised to become a hub for cross-border trade finance. Dubai’s growing stature as a re-export and logistics hub—combined with Riyadh’s rising financial clout—gives the GCC geographic and capital leverage most regions don’t enjoy.

Local banks are diversifying from conventional lending into trade and working capital finance, backing SMEs and mid-market enterprises across sectors.

Supply chain and trade finance provides that path—letting them deploy capital securely, support SMEs, and fund real economic activity.

The UAE is already being called a “global powerhouse” for supply chain finance. And it’s not hard to see why.

UAE and Saudi Arabia: Leading the Frontier

TSaudi Arabia’s Vision 2030 explicitly targets a robust financial sector and SME access to credit, including a goal to nurture 500+ fintech companies by 2030.

Regulators (SAMA and CMA) have launched fintech sandboxes, new licenses, and an Open Banking Framework to spur innovation.

“The ultimate aim is to achieve over 525 operating fintechs in Saudi Arabia; create over 18,000 jobs in the fintech domain; accumulate over 12billion Saudi Riyal of investment in fintech companies; as well as generate 13 billion Saudi Riyal in Saudi GDP”

- Saudi Central Bank (SAMA) Governor Ayman Al-Sayari

Meanwhile, the UAE is driving fintech adoption through innovation hubs like DIFC FinTech Hive and Dubai Future Accelerators, offering a supportive framework for embedded lending and working capital platforms.

CredAble’s Digital Public Infrastructure (DPI) Impact Plugins

Both economies are also wiring themselves with world-class digital public infrastructure. Whether it's real-time payment rails or digital ID frameworks like UAE Pass, Emara Tax, the groundwork is being laid for embedded finance to scale without friction. UAE’s digital maturity (219% mobile connections vs. population) creates an ideal environment for real-time lending infrastructure.

CredAble, as a leading working capital technology platform, is embedded into these capital flows—delivering AI led underwriting, data-backed invoice discounting, and end-to-end SCF solutions. We understand that speed in credit isn’t just about automation—it’s about trust in data.

In the GCC, we're helping financial institutions go beyond traditional underwriting—by plugging directly into DPI layers, and stitching together real-time, contextual signals that reflect true creditworthiness.

Explore DPI PluginsEmbedded Finance: From Buzzword to Backbone

Nowhere is the DPI investment more evident than in embedded finance.

The UAE’s embedded finance market is projected to triple—from $1.9 billion in 2024 to $6.6 billion by 2029—on the back of e-commerce integration, BNPL models, and supply chain financing integrations embedded directly into B2B procurement flows.

This convergence of fintech and traditional supply chains means more companies can access financing at the click of a button.

The GCC’s commitment to these enablers is allowing SCF and trade finance solutions to scale faster and at lower cost. It also encourages non-bank innovators to enter the market, embedding finance in sectors from manufacturing to agriculture.

Ultimately, embedded finance underpinned by robust DPI can drive greater financial inclusion for SMEs – a core goal under Saudi and UAE national strategies.

Strategic Actions for Banks and Corporates

As the GCC reshapes its trade finance ecosystem, both banks and corporates have an opportunity to align with the region’s digital and policy momentum.

- Banks & Fintechs:

Banks that partner with API-native SCF platforms (with capabilities like AI-driven underwriting or real-time invoice validation) can now serve SMEs at scale, without overexposing their balance sheets.

Initiatives like the Emirates Development Bank’s SCF partnerships are early proof points.

There’s also a growing case for embedding ESG-linked SCF solutions—tying pricing to sustainability benchmarks and staying ahead of investor and regulatory demands.

- Corporate Treasurers:

Treating working capital as a strategic lever, not just a finance metric, can unlock significant value. Given that over $50 billion remains trapped in GCC working capital cycles - digitizing invoices, integrating SCF into ERP systems, and rolling out early payment programs can improve liquidity while strengthening supplier ecosystems.

Why the Gulf Matters More Than Ever

This isn’t just about regional ambition. The rise of the GCC as a trade finance nerve center reflects a broader truth: the future of SCF will be defined by data, not geography.

And right now, the UAE and Saudi Arabia are building the cleanest datasets, the strongest rails, and the boldest policy environments for that future.

For banks, fintechs, and corporates watching from the sidelines—the message is clear: engage now.

The Gulf isn’t just closing the trade finance gap. It’s setting the global benchmark for how to do it right.

At CredAble, we’re proud to be part of that shift—powering global banks and large enterprises with the infrastructure to scale working capital solutions that are embedded, intelligent, and inclusive. As the Gulf builds the rails, we’re building the trust layer that makes capital flow smarter, faster.

Talk to our ExpertsThink Working Capital… Think CredAble!