Tariff-Driven Trade Volatility: Why the $9.7 Trillion Trade Finance Engine Is Under Strain

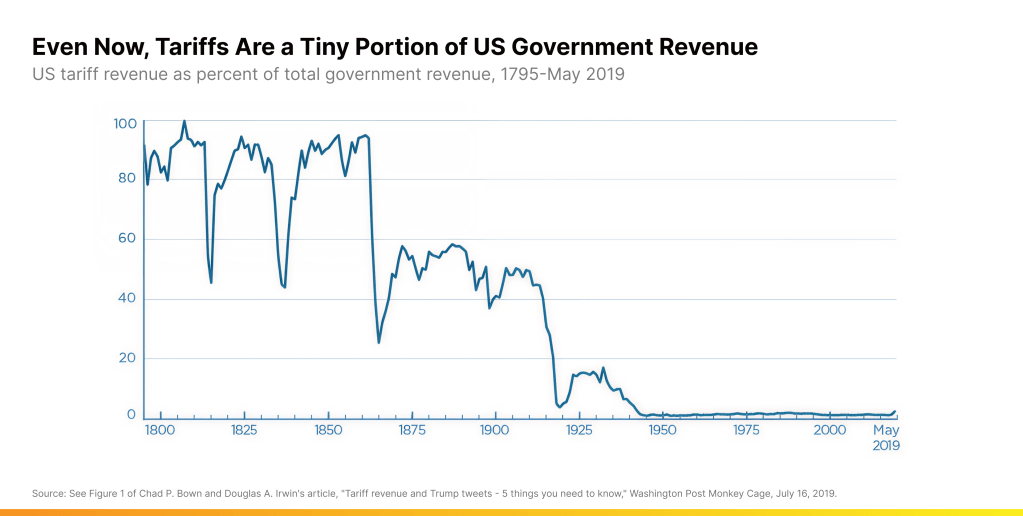

For much of the 19th century, tariffs were the backbone of U.S. government revenues, constituting nearly 90% of total collections. But that paradigm shifted radically post-WWII as free trade principles gained momentum and income tax replaced tariffs as the primary fiscal tool.

Fast forward to 2025, and we are once again witnessing a sharp reversal. The United States has imposed sweeping tariffs—of 145% on Chinese imports—as part of a renewed “America First” doctrine. Other trade partners like Mexico and Canada have also seen new levies of 25%, with retaliatory duties and import tariffs to China now heading up to 245%.

These developments signal not just a trade skirmish, but a structural reset of the global trading architecture. The impact?

An estimated $9.7 trillion trade finance market is now facing increased fragmentation, margin compression, and a complete reshuffle of geopolitical risk models.

The Shock to Global Trade and GDP Forecasts

According to the World Trade Organization (WTO), global merchandise trade volume is expected to contract by 0.2% in 2025, a stark drop from earlier forecasts of 2.8%–3% growth.

Simultaneously, global GDP growth is forecasted at just 2.2%, down from 2.6% previously projected and well below the 6.4% bounce-back seen in 2021.

This new macro reality is pushing financial institutions to reprice trade risk, revisit supply chain finance models, and embrace more agile, localised underwriting strategies.

For supply chain financiers, these shocks have increased credit risk, stressed underwriting standards, and made liquidity deployment across borders more complex. As trade routes fragment and protectionism rises, the role of trade finance is evolving rapidly—from a stable enabler to a dynamic, risk-sensitive tool.

But let’s see how we got here.

Trade Finance: A $9.7 Trillion Engine Under Duress

The global trade finance ecosystem funds around 80% of international trade, relying on instruments like Letters of Credit (LCs), Export Credit Agency (ECA) support, and Supply Chain Finance (SCF).

But today, multiple pressures are emerging:

- Higher default risks in sectors like electronics, agriculture, and steel.

- Reduced tenors, with banks preferring 30–60 days over traditional 90–180 day structures.

- Withdrawal of cross-border credit lines in high-volatility trade corridors.

As per OMFIF, many banks are now integrating geopolitical tariff exposure into their credit risk frameworks, resulting in higher capital charges and lower limits for clients operating in affected sectors.

Asia Rebalances: Trade Routes Rerouted

The U.S.–China tariff escalation is accelerating the “China+1” strategy, where global manufacturers are diversifying into ASEAN, India, and Africa.

This geographic rebalancing is creating new opportunities—and new complexities:

- Singapore and Dubai are becoming regional trade finance centres with local-currency financing and rerouted flows.

- South-South trade (e.g., India–Africa, ASEAN–Middle East) is gaining traction as lower-risk corridors.

- Local ECAs and government agencies are stepping in with guarantees and liquidity backstops to prevent a freeze in trade flow.

For example, in April 2025, the UK expanded its UKEF capacity by £20 billion, specifically targeting sectors hit by U.S. tariffs.

How Banks Are Responding

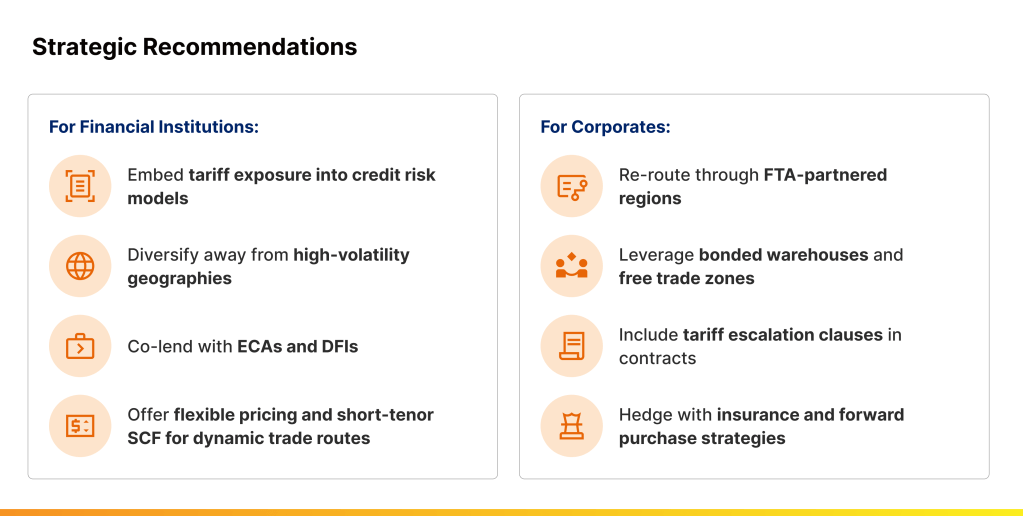

Financial institutions are adapting in five major ways:

1. Risk Recalibration

Banks are embedding tariff risks into pricing models. Portfolios are now segmented based on geopolitical exposure, with higher premiums on U.S.–China and lower spreads for intra-EU or intra-Asia trades.

2. Shorter Tenors, Higher Spreads

To control uncertainty, banks are offering short-term working capital lines (30–60 days) with higher risk-adjusted returns.

3. Repackaged Trade Instruments

Classic LCs are now bundled with trade credit insurance, FX hedging, and tariff escalation clauses in supplier contracts.

4. ECAs and DFIs Step In

Agencies like UKEF, China Exim Bank, and IFC are actively participating in syndications to reduce risk and boost capacity.

5. Capital Reallocation

Banks are pulling back from trans-Pacific exposures and doubling down on regional corridors. This capital flight is particularly visible in APAC and MENA, where flexible pricing and co-lending models are flourishing.

Conclusion: A Trade Finance Reset Is Underway

The current tariff wave is more than a policy shift—it’s a structural disruption to global commerce.

In this new regime, successful institutions will:

- Embrace data-rich, region-specific pricing models.

- Invest in real-time credit monitoring and adaptive risk infrastructure.

- Forge stronger public-private partnerships through ECAs and sovereign-backed facilities.

As the global economy inches toward regionalisation and resiliency, those who adapt early—across lending, underwriting, and logistics—will lead the next chapter of trade finance.

Think Working Capital… Think CredAble!