The AI Revolution in Accounts Payable: Powering the Next Era of Working Capital Management

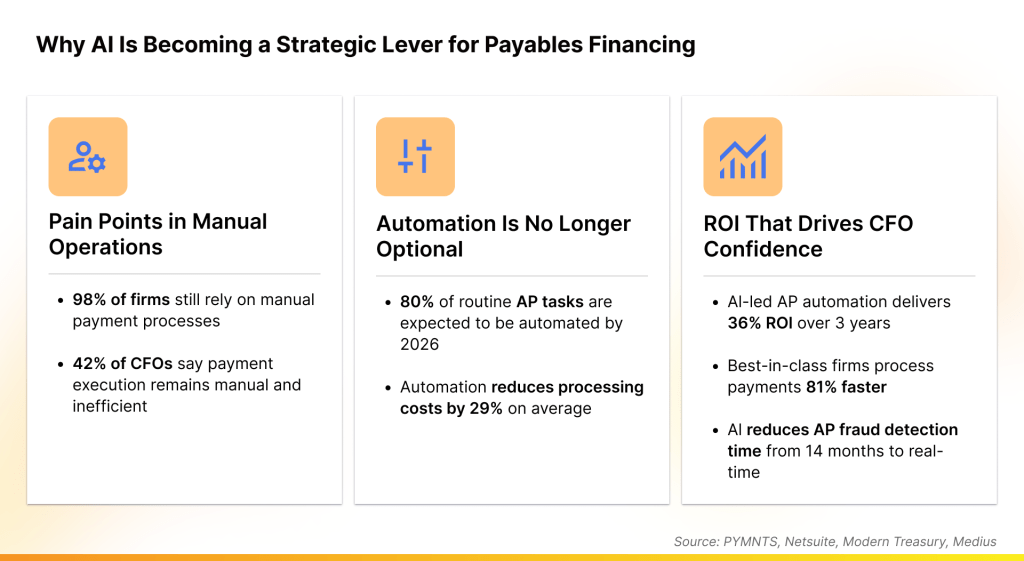

In 2025, the transformation of Accounts Payable (AP) is no longer a vision—it's a velocity. With 74% of AP departments already leveraging AI and automation, and 98% still grappling with legacy manual processes, the transition from a back-office cost centre to a strategic value engine is well underway.

In both global and India-specific markets, Artificial Intelligence (AI) is becoming the backbone of smarter, faster, and more resilient working capital management.

This isn’t about automating tasks—it’s about redefining supply chains.

From Back Office to Strategic Powerhouse

For years, AP was perceived as a routine, reactive function. But today, as economic uncertainty persists and supply chains stretch across geographies, businesses can no longer afford inefficiencies in their payables ecosystem.

We build our 68% of CFOs say outdated payment systems waste time, and 42% admit that manual processes are the single biggest source of Account Payable delays.

AI flips this equation. By embedding intelligence into every step—invoice ingestion, matching, payment scheduling, and reporting; AI enables accounts payable teams to do more than just pay bills. They now influence liquidity, shape cash flow strategy, and create value through dynamic early payment programs and predictive analytics.

Intelligent Invoice Automation: Eliminating the Friction

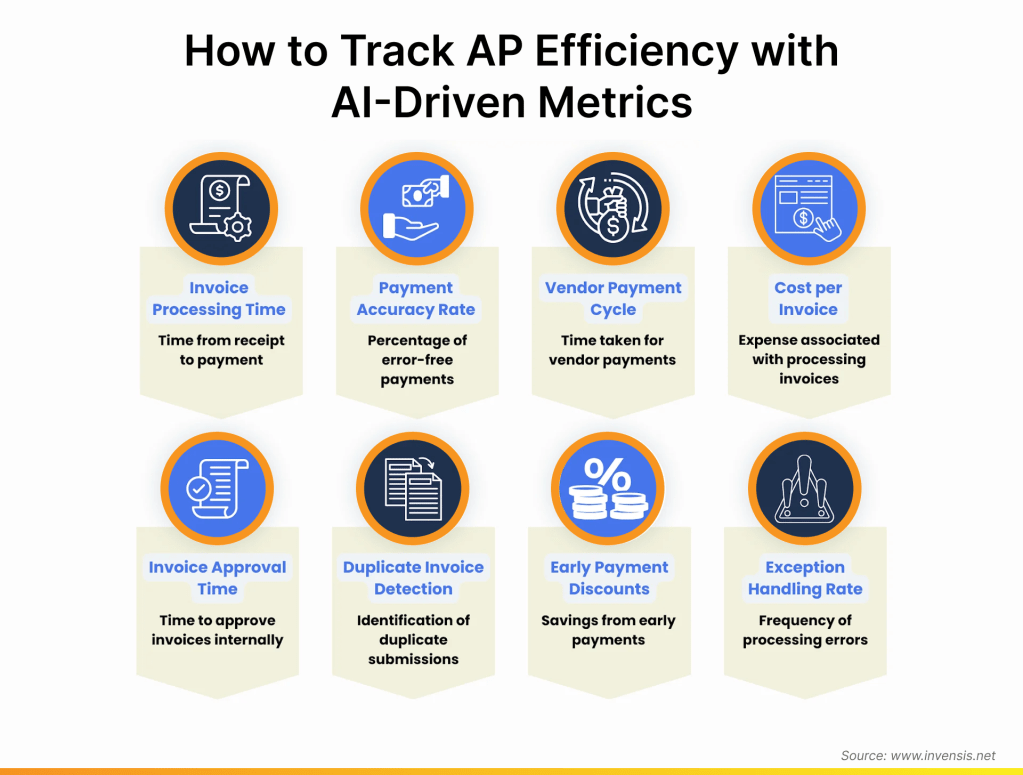

At the core of this transformation lies automated invoice processing. Traditional systems struggle with varied invoice formats, manual validation, and error-prone reconciliation. AI, when integrated with Optical Character Recognition (OCR), Natural Language Processing (NLP), and ERP systems, enables straight-through processing (STP).

This means invoices can be scanned, understood, matched, and routed for approval without human intervention—cutting invoice processing costs by up to 76% and accelerating payment cycles by 81%.

This not only ensures timely vendor payments but also opens doors to strategic levers for dynamic discounting.

In India, where MSMEs often rely heavily on timely invoice clearance to manage liquidity, AI-driven invoice automation can address long-standing payment delays, reducing dependency on informal lending.

Explore real-time vendor payouts via CredAble’s EPP suiteEarly Payment Programs: Liquidity at the Speed of Business

One of AI’s most immediate applications in payables is the orchestration of early payment programs (EPPs). AI engines analyse supplier behaviours, payment terms, and real-time cash flow to identify optimal timing for early settlements.

This is particularly critical for anchor-led ecosystems in sectors like manufacturing, retail, and FMCG, where Tier-2 and Tier-3 suppliers face working capital gaps.

90% of businesses are now open to considering innovative trade finance products and services. This will be a boon to the corporates and their ecosystem of MSME suppliers in India.

Dynamic discounting—triggered when AI detects surplus liquidity—allows corporates to pay early in exchange for a discount, creating a win-win. Companies can reclaim up to 2% of their total spend via EPPs when managed proactively.

For India, where delayed payments to MSMEs remain a structural hurdle, AI-enabled payables financing could dramatically boost on-time payment adherence under the MSMED Act and reduce receivable cycles by over 20 days.

Transform your AP into a liquidity engine with Early Payment SolutionsPredictive Analytics: The Crystal Ball for CFOs

CFOs today are expected to be strategic architects of liquidity. AI enables this by layering predictive analytics on top of real-time accounts payables data. Through deep learning models trained on historical payment trends, supplier patterns, and seasonal cash flow fluctuations, AI can forecast payables, optimize payment timing, and simulate the financial impact of different payment strategies.

Mid-market firms using AI in at least half of their AP functions are 47% less likely to face operational uncertainty.

In India, where mid-sized firms face the brunt of interest rate volatility and payment unpredictability, predictive payables analytics can serve as a liquidity shield.

Agentic AI: The Next Leap in Intelligent Payables

Agentic AI—systems that can plan, reason, and act autonomously with minimal input. In the accounts payables space, agentic AI could soon take charge of end-to-end payment orchestration: initiating early payments when discounts are attractive, raising red flags for anomalous vendor behaviours, or reallocating payables schedules based on real-time liquidity signals.

Agentic systems will also likely drive automated vendor negotiations, contract intelligence, and fraud prevention—learning from historic interactions and external datasets. These systems mark a paradigm shift from passive automation to proactive finance agents.

Imagine an AI agent that not only processes a vendor invoice but decides whether to pay now, later, or partially, based on forecasts, liquidity buffers, and risk parameters—without human intervention. This is no longer theoretical. It’s the immediate frontier.

AI-Powered Fraud Detection and Compliance

According to the Association of Certified Fraud Examiners, billing frauds cost organizations an average of $5,600 per month and linger undetected for over a year.

AI’s pattern-recognition capabilities drastically cut this timeline. Anomalies like duplicate invoices, inflated amounts, and unusual vendor behaviour are flagged in real-time, improving compliance and minimizing financial leakage.

Moreover, regulatory environments in India (such as mandatory e-invoicing for GST) require dynamic validation and audit-readiness. AI helps auto-map invoices to GST ledgers, flag mismatches, and generate compliance reports at scale.

Seamless ERP Integration: The Nervous System of AI in AP

To deliver meaningful outcomes, AI must be deeply embedded into ERP and treasury systems. Best-in-class AI solutions today offer APIs that sync invoice data, payment workflows, and supplier terms across departments—bridging finance, procurement, and compliance.

In India, ERP integration is no longer restricted to large enterprises. New-age vertical SaaS providers are delivering plug-and-play AI modules tailored to sectors like logistics, textiles, and pharmaceuticals—empowering even mid-sized companies with enterprise-grade AP intelligence.

Challenges to Watch: Data, Talent, and Strategy

While the promise is immense, AI implementation is not without its hurdles. Three key friction points include:

- Data quality: AI thrives on clean, consistent data. In India, where vendor records often exist in disparate formats, significant effort is required to prepare training data sets.

- Change management: 64% of AP professionals are concerned about reduced human oversight. Embedding human-in-the-loop strategies can help balance automation with governance.

- Lack of strategy: 31% of firms still lack a clear vision for AI in finance. A roadmap that aligns AI capabilities with business priorities is crucial for scalable ROI.

India: A Unique Case for AI in Working Capital Financing

India’s $530 billion MSME credit gap, combined with delayed B2B payments and GST-led digitalization, makes the country a prime market for AI-led payables transformation. Platforms like the Trade Receivables Discounting System (TReDS), GSTN, and government initiatives on e-invoicing create a foundational DPI (Digital Public Infrastructure) upon which AI models can be trained and deployed at scale.

Fintechs are already leveraging AI to underwrite invoices, predict default risks, and manage EPPs for MSMEs. As adoption grows, we’ll likely see India leapfrog traditional models and become a global case study in AI-driven payables financing.

Payables as a Profit Centre

AI in accounts payable is no longer about reducing cost—it’s about expanding financial intelligence. By automating what is tedious and augmenting what is strategic, AI transforms AP into a growth enabler. From early payment discounts to real-time analytics and fraud prevention, the value delivered extends beyond the department.

In 2025, the companies that thrive won’t be those with the fastest processors—they’ll be those with the smartest payables.

Think Working Capital… Think CredAble!