Trump’s Trade War Call for a Renewed Focus on India’s Supply Chain Ecosystem

The global economy is treading into uncharted territory.

Trade markets are in a meltdown mode.

And all eyes are on U.S. President Donald Trump as he could potentially kick-start a multi-front trade war with Canada, Mexico, and China.

On returning to the White House, Trump set off a global alarm by signing executive orders placing 25% tariffs on all goods from Canada and Mexico, as well as a 10% tariff on Chinese imports.

While Trump has since delayed imposing those tariffs on Canada and Mexico—the tariff of 10% on Chinese imports has come into effect.

As per recent reports, Trump is expected to announce reciprocal tariffs, opening up new fronts in a fast-growing trade war with other nations.

Following Trump's directive imposing sweeping reciprocal tariffs on all U.S. trading partners, Indian Prime Minister Narendra Modi's two-day U.S. visit aimed to address the trade imbalance. As part of the discussions, India committed to increasing its imports of U.S. oil and gas to help reduce the trade deficit.

The two leaders concluded the meeting, setting an ambitious target of doubling their bilateral trade to $500 billion by 2030, and proposed working on a mutually beneficial trade agreement, prioritising the need for an energy-secure future and stronger trade partnerships.

Though we are yet to see wide-reaching implications of this on India’s trade dynamics—Trump’s trade policies have already created ripple effects across the nation’s economy, influencing everything from the Rupee’s value to exports, manufacturers, and the supply chain ecosystem.

- How is India reacting to the global trade tensions?

- What measures will strengthen the country’s manufacturing sector?

Let’s find out.

India reacts with a quick cut on import duties

As tariff battles sparked fears of a trade war, one of the immediate knock-down impacts was the plunge in the Rupee.

The Rupee hit a record low of ₹87.28 against the U.S. dollar, following the announcement of tariffs on imports, and it closed at ₹87.19, marking it the sharpest single-day drop in two weeks. This drop compounds the strain on India's import-driven economy—especially in sectors that are dependent on raw materials like oil and electronics.

India imports approximately 87% of its crude oil in USD. The weakening Rupee has led to higher import costs—severely impacting the prices of petrol, diesel, plastics, and fertilisers. To ward off any threat of tariffs, India has been quick to slash import duties on high-end motorcycles.

Growing pressure on capital and supply chain resilience

The reciprocal tariffs strategy aligns with Trump's stance on making trade relations fair for American exports. As per the plan, if reciprocal tariffs come into effect, it would align U.S. tariffs with the tariff rates imposed by other countries on U.S. imports. The reciprocal tariffs could hit India harder, as it levies a 9.5% tariff on U.S. goods—more than three times the U.S.'s 3% tariff on Indian exports.

With trade disruptions rising, there are two immediate concerns for Indian businesses:

- Supply chain shifts: Rising import costs and longer settlement cycles mean suppliers will need access to working capital sooner. Businesses that delay payments due to liquidity constraints risk losing key supplier relationships, making supply chain financing a critical enabler.

- Dumping risks: There is also a possibility that the trade wars may result in India becoming a dumping ground for surplus exports, resulting in the rise of low-cost goods that can undercut local businesses.

With trade flow being rerouted, India is already starting to see a shift in supply chains—Titan reported challenges amidst increasing costs of critical gold imports.

Is this a blessing in disguise for India's exports?

While the depreciation of the Rupee poses significant challenges and tariff threats loom, these trade disruptions can also pave the way for India to capitalise on a potential export boom.

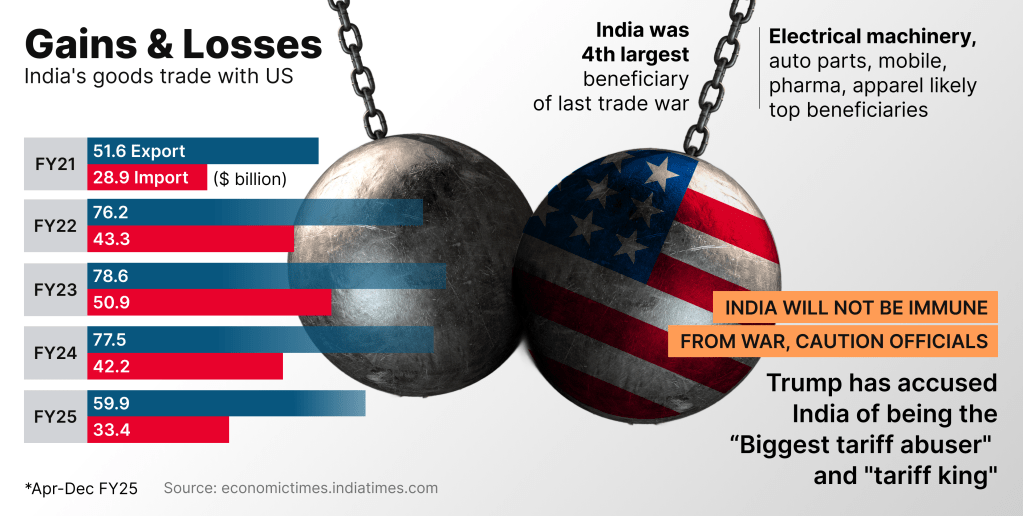

As one of the U.S.’s largest trading partners and with bilateral trade surpassing $190 billion annually, India stands to benefit from these new tariffs. The country's exports to the U.S. grew by 46% in the past four years, reaching $77.5 billion.

Industry experts pronounce a $25 billion gain for India from additional exports coming in owing to the US-China trade war.

With manufacturing costs in China on the rise owing to tariffs, companies around the world are looking for alternate production hubs. Given its growing manufacturing base, recent budget boost, and government-backed initiatives like Production-Linked Incentives (PLI)—India is a strong contender for export, especially in sectors like electronics, automotive parts, pharmaceuticals, and textiles.

In his meeting with Modi, Trump also hinted at "separate big trade deals" with India and a “new global trade route” that will be announced in the near future. For businesses to make the most of this moment, access to affordable working capital financing will be key. Working capital cycles are becoming more complex, and at a time like this, it is crucial to ensure suppliers have access to steady financing. This will determine India's path ahead in the new supply chains.

Working capital financing becomes a competitive advantage

In response to the trade tensions, the government of India has been making moves to ease the strain on its economy. The latest budget proposals target a boost for the Micro, Small, and Medium Enterprises (MSMEs) as well as the country's manufacturing and export economy.

The growth of India's manufacturing and export sectors largely relies on access to adequate working capital. FinTech platforms like CredAble are offering tech-enabled working capital financing solutions that empower manufacturers to scale rapidly without incurring unnecessary financing burdens.

- Structured working capital and anchor-led supply chain financing solutions will play a defining role.

- Early payment solutions will allow businesses to unlock liquidity without straining their balance sheets, ensuring suppliers receive payments in weeks rather than months.

- Dynamic discounting models will help optimise cash flows, allowing businesses to manage margins effectively despite currency fluctuations.

Digital trade finance platforms will enable more businesses, especially MSMEs, to access capital at competitive rates, reducing reliance on traditional lending. g algorithms and AI, CredAble is automating the end-to-end channel financing experience, offering corporates and their dealer ecosystem greater visibility and control over their inventory and finances—in turn, helping them make informed financial decisions about the business.

Can India replace China as the world's factory floor?

As India positions itself as a global supply chain alternative, the key question is whether businesses can scale efficiently. Market access alone isn’t enough—companies need financial agility to move quickly. The ability to ensure seamless supplier payments, optimise working capital, and absorb cost fluctuations will define sustained competitiveness.

This is not a short-term adjustment but a long-term shift in global trade dynamics. Indian businesses that align their financial strategies with supply chain resilience will not just weather these changes but emerge stronger in the new global order.

Think Working Capital… Think CredAble!