How the Unpaid Dues of INR 26,414 Crore Are Threatening MSMEs’ Working Capital Stability

In today’s global marketplace, the need for supportive measures for the Micro, Small, and Medium Enterprises (MSMEs) sector cannot be overstated.

Among the many roadblocks that MSMEs face is the lack of access to affordable and flexible working capital financing. The government of India has made concerted efforts to ease access to credit for MSMEs through priority sector lending obligations, not to mention the growing digitalisation of the economy as a whole, GST implementation, explosive growth in UPI, and the digital public infrastructure.

Having said that, the rigid lending norms coupled with the lack of reliable data relating to the MSME’s financial health have hindered the process.

With MSMEs having a critical role to play in Viksit Bharat, we need innovative working capital solutions and a forward-looking ecosystem to bolster the sector’s growth in India.

Taking stock of the issue

With delayed payments to the sector reaching alarming proportions, the MSMEs’ glaring credit gap of INR 20–25 lakh crore is starting to impact their ability to meet obligations and keep their operations running smoothly.

Here’s a closer look at the gravity of the problem:

- The total delayed payments to MSMEs are equivalent to 7.8% of India’s GDP.

- With the mounting delayed payments, MSMEs are facing massive fund shortages, forcing them to miss or postpone vendor payments and put large orders on hold.

- Many of the MSMEs supply to export markets. Given how the flow of credit to the MSME segment remains weak—the production and delivery timelines end up taking a hit, eventually leading to ripple effects across global supply chains.

- As a result of delayed payments, MSMEs lose out on competitive bidding for large contracts or even the ability to capitalise on bulk purchasing discounts, further increasing their costs. It also hampers their ability to scale production and enter thriving, export-heavy sectors like textiles.

- Limited working capital is also hampering investments in growth initiatives and innovation, further stunting the expansion of the sector.

The impact on businesses

MSMEs are up against a persistent battle with delayed payments disrupting cash flow and jeopardising their financial health.

Liquidity constraints

These delayed payments snowball into cash flow issues, taking a toll on the MSME's ability to manage salaries, day-to-day expenses, utility bills, and supplier payments.

Missed opportunities and financial instability

Delayed payments to MSMEs can cause significant supply chain disruptions and other challenges across various industries.

Let's take the manufacturing industry as an example.

In this sector, the production and payment cycle can take up to 180 days, which includes:

- 60-day production process

- 30-day transit process

- 90-day letter of credit

As a result, payments are released beyond the 180-day cycle, with MSMEs struggling to sustain production and procurement of raw materials, leading to slowdowns, struggles to fulfil orders, and adversely impacting profitability.

Operational bottlenecks due to high-value pending payments

MSMEs may struggle to maintain optimal inventory levels, leading to stockouts or overstocking, both detrimental to business health.

In a bid to seek financing and owing to the risks associated with MSME exposures—these businesses resort to high-interest loans, further escalating their financial burdens.

For instance, in 2024, some small businesses had to incur interest rates of up to 26% per annum, impacting their ability to service loans and increasing default risks.

What we need today is a multifaceted approach to address these challenges, including enhancing the efficiency of platforms like Samadhaan, promoting the use of dynamic discounting platforms as well as platforms like TReDS for quicker payments, and implementing regulatory reforms to support MSMEs' financial health.

The role of the Samadhaan portal

The Samadhaan portal has been an effective mechanism for addressing MSME payment issues.

Despite its intended purpose, there are a few inefficiencies in processing cases.

Current inefficiencies in processing cases:

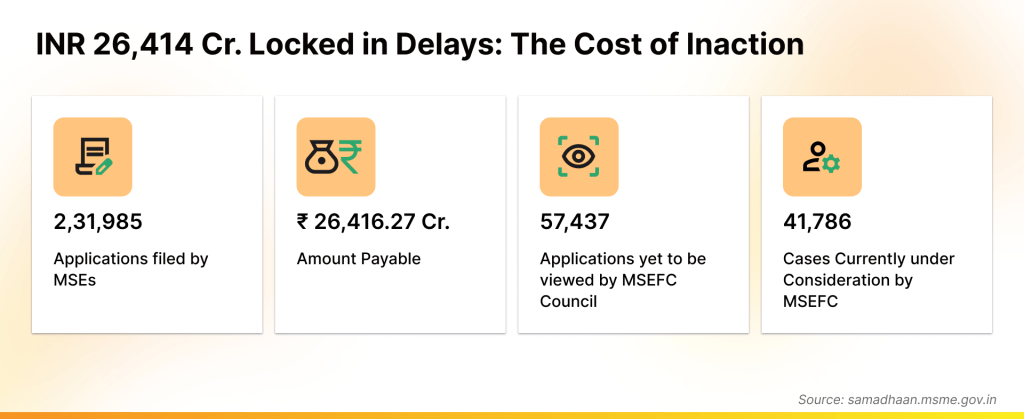

A high volume of applications: As of April 2025, MSMEs have filed over 2,31,975 applications concerning delayed payments that have increased from INR 21,108 crore (in October) to INR 26,414 crore.

Pending applications:

- 57,433 applications are yet to be reviewed by the MSEFC Council

- 41,782 applications are currently under consideration

Low disposal rate: Only about 10% of the applications have been disposed of or mutually settled.

The number of delayed payment cases filed by MSMEs has seen a marked increase in recent months. Small businesses have filed over 47,000 applications in FY25 to recover delayed payments worth INR 8,024.9 crore, registering a sharp 94.1% rise in the number of applications.

In addition to being overwhelmed with a high volume of applications, many of the state-level Micro and Small Enterprise Facilitation Councils (MSEFCs) lack adequate resources and the infrastructure to address and resolve the applications filed on the Samadhaan portal.

Additionally, the legal and procedural complexities involved in dispute resolution can further prolong the settlement process.

The need to take an all-round approach to tackling processing delays

Addressing MSME payment delays calls for a comprehensive approach that involves the buyers, utilisation of platforms like TReDs, and timely regulatory changes that are key to creating a supporting ecosystem.

Buyers need to build trust through timely payments:

- Honouring agreed-upon payment schedules is important to foster strong supplier relationships.

- Further, leveraging the digital invoice financing platform allows buyers to settle invoices efficiently.

- Incase of large supplier base for a homogenous goods, exploring structured trade transactions to ensure timely payments to MSMEs without putting pressure on the production cycle.

Why MSMEs Need Digitally-Native Invoice Discounting Platforms —Not Just Policy Infrastructure

Digitally native invoice discounting platforms are engineered for real-world MSME trade dynamics:

- Pre-Invoice Financing and Anchor-Driven Liquidity

Modern platforms integrate with anchor buyers’ ERP systems to predict payables before invoices are even generated—enabling early payment offers as soon as the goods are delivered or services consumed. This bridges liquidity gaps before they impact the MSME’s cash cycle.

- AI-Backed Credit Assessment on Buyer Intent

Instead of relying on MSME balance sheets or GST data alone, these platforms evaluate anchor buyer repayment behaviours, enabling risk underwriting based on transaction patterns. This unlocks working capital for MSMEs who may not meet traditional banking thresholds.

- Access for Deep-Tier and Informal Suppliers

Digitally native solutions allow financing against purchase orders, delivery challans, or even e-way bills, widening access for suppliers in textiles, logistics, agro-processing, and other informal MSME ecosystems that aren’t invoice-centric.

- Dynamic Discounting via Smart Contracting

Modern platforms enable buyers to run on-demand reverse auctions where suppliers can bid for early payment at a discount—resulting in liquidity access within same day while letting buyers manage treasury float efficiently.

Paving the path to faster payment settlements for MSMEs

Ensuring timely payments to MSMEs is crucial for their sustainability and growth.

Implementing mandatory settlement timelines, such as the 45-day MSME payment rule under Section 43B(h) of the Income Tax Act, will enforce quick payments to MSMEs.

By linking tax compliance to the settlement of MSME payments within 45 days—this rule incentivises buyers to prioritise timely payments, promoting discipline in payment cycles. Holding buyers accountable through tax-related consequences and financial penalties will ensure that buyers adhere to payment deadlines and in turn, reduce delays for MSMEs.

Digitally-native invoice discounting platforms, when embedded across the value chain, can unlock working capital in less than 48 hours, without adding debt or waiting for regulatory enforcement. In a world where INR 26,414 crore in dues sit unpaid, this isn’t just optional innovation—it’s critical infrastructure.

Think Working Capital… Think CredAble!