The Rise of Multipolar Trade and the Future of Working Capital in 2026

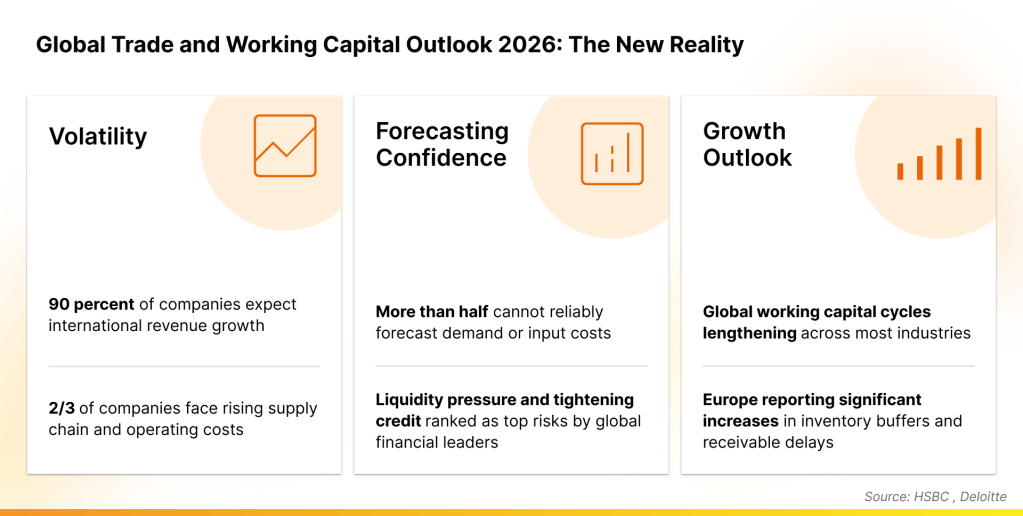

As the global economy moves into 2026, volatility has reached its highest level in more than a decade. Supply chain costs continue to rise, and two thirds of companies report increased operational pressure. Across Europe, businesses are carrying heavier working capital cycles and absorbing longer cash conversion periods.

Despite these pressures, the global outlook remains resilient. Close to 90% of companies still expect international growth, even as more than half say they cannot reliably forecast demand or input costs.

This contradiction defines the current global trade environment. Businesses are no longer waiting for certainty to return. Instead, they are designing operating models that can perform in unpredictable conditions.

This shift is laying the foundation for the next phase of global trade finance and working capital optimisation.

Volatility Is Now the Default Setting in Global Trade Finance

Across global C-suites, there is broad recognition that cost volatility, geopolitical fragmentation, and supply chain delays will persist through 2026. Companies that once prioritised efficiency are now optimising for resilience and liquidity strength.

A majority of businesses expect trade-related costs to increase through 2026, while nearly 90% still anticipate growth in cross-border revenues. This reflects a deeper structural transition in global trade finance trends.

Global financial leaders increasingly view liquidity pressure and tightening credit conditions as the most significant emerging risks. When volatility becomes systemic, business models must be built to operate within it, absorb it, and continue expanding despite it.

Companies that adapt will not succeed by predicting stability, but by developing systems capable of withstanding prolonged uncertainty.

Global Supply Chains Are Shifting from Linear to Multipolar Networks

One of the most significant transformations shaping trade finance in 2026 is the reconfiguration of global supply chains. The world is not de-globalising. It is re-globalising in a different form.

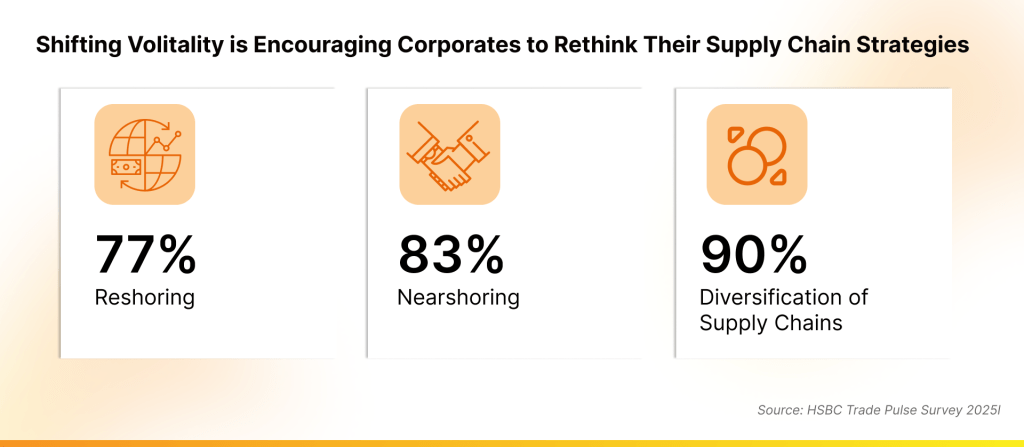

Companies are moving production closer to key consumer markets, expanding multi-region supplier bases, and introducing redundancy where single-region dependence once existed. Reshoring, nearshoring, and supplier diversification have become mainstream strategies.

Around 90% of organisations plan to expand or rebalance supplier networks across regions. Europe, the Middle East, and South Asia are emerging as strong nodes within this multipolar supply chain architecture. At the same time, Emerging Asia continues to experience rapid growth in trade finance activity, driven by manufacturing strength and regional integration.

The companies that succeed will be those that build flexible supply networks that remain liquid, visible, and responsive across markets.

Build liquidity-ready supply chainsLiquidity Has Become a Strategic Advantage in Working Capital Management

As supply chains become more complex, liquidity has taken centre stage in global business strategy. Working capital is no longer a secondary financial metric. It is the foundation that enables companies to operate and expand through uncertainty.

A clear trend has emerged. Companies are increasingly relying on shorter tenor working capital financing.

Around 67% of businesses report increased use of short-term liquidity solutions as trade costs rise.

Access short-term liquidity with CredAbleThis reflects a strategic shift in working capital management. Liquidity is no longer confined to back-office measurement. It has become a competitive advantage. European markets have seen deterioration in working capital efficiency due to slower receivables and higher inventory buffers.

Businesses with tighter cash conversion cycles demonstrate greater resilience and are better positioned to capture new market share, expand geographically, and absorb supply chain disruptions.

As global working capital cycles continue to lengthen, companies that treat liquidity as a core capability will shape the next generation of trade finance.

Business Confidence Remains High Because Operating Models Are Evolving

Despite reduced forecasting accuracy and heightened market instability, global organisations continue to maintain strong expansion plans. More than half of companies struggle to predict demand and costs confidently, yet almost all still expect to grow cross-border activity.

This confidence is grounded in structural action rather than optimism. Companies are redesigning supply, financial, and credit flows with greater sophistication. Dual sourcing, distributed production, receivables securitisation, dynamic discounting, and ecosystem partnerships are becoming increasingly common.

More than 40% of high-growth businesses have already implemented nearshoring or multi-region sourcing strategies and are investing heavily in technology to strengthen resilience. Confidence now comes from systems that do not rely on stability to function.

Technology Is Becoming the Operating System of Global Trade

The most powerful driver of change in global trade finance is digitalisation. With more than four billion paper documents still in circulation globally, technology is no longer optional. It is foundational.

Across industries, almost 9 in 10 companies say they are adopting or planning to adopt digital visibility tools, automated workflows, analytics platforms, and real-time supply chain systems. Low-code platforms are accelerating this transformation by allowing businesses to build and customise trade workflows without complex development cycles.

Document digitisation, automated risk scoring, real-time payments, and end-to-end trade visibility are becoming standard expectations across trade ecosystems.

The rise of agentic AI marks another major shift. AI-powered systems can now analyse documents, detect anomalies, evaluate risk, and trigger workflows with minimal human intervention. These tools accelerate compliance processes, enhance risk management, and release liquidity faster.

Digitise working capital with CredAbleConsulting research indicates that the next breakthrough in working capital performance will come from machine-learning-based cash forecasting, embedded finance solutions, and interoperable trade ecosystems powered by AI. Technology has effectively become the infrastructure layer of global trade, connecting buyers, suppliers, financiers, logistics providers, and regulatory systems into a unified digital environment.

Financial Partners Are Being Redefined as Strategic Enablers

As companies expand across multiple markets, expectations from financial partners are evolving. Businesses are seeking more than capital. They want strategic partners who can support risk navigation, supply chain restructuring, and liquidity optimisation.

More than 80% of corporates now expect advisory support across crisis planning, compliance, restructuring, and market entry. Treasury teams are increasingly prioritising integrated liquidity architectures that operate seamlessly across borders.

Financial institutions that digitise trade journeys, provide cross-border liquidity support, and embed financing directly into supply chain flows will emerge as long-term strategic enablers rather than transactional providers.

Looking Ahead: Trade Is Being Rewritten

The global trade landscape of 2026 will not be shaped by predictable cycles. It will be shaped by companies that build for unpredictability.

Businesses that remain liquid despite volatility, maintain visibility across fragmented and multipolar supply chains, and continue expanding even when forecasting accuracy is low will define the next era of global trade finance.

Trade is not slowing down. Trade is reorganising. Companies that align with this reorganisation will lead the future of global commerce.

Think Working Capital… Think CredAble!