Understanding Flash Title Trade: A practical guide to Structured Trade Solutions by CredAble

Flash Title Trade is an increasingly used approach within Structured Trade Solutions that helps businesses unlock liquidity from their payables. As global supply chains become more complex and working capital cycles lengthen, companies are looking for alternative ways to secure working capital without relying on traditional routes of financing.

How Flash Title Trade Works

Large conglomerates operate within vast and complex supplier networks of different scale. Their fragmented nature entails extensive process, manual interventions, management effort and limited scope for credit extension.

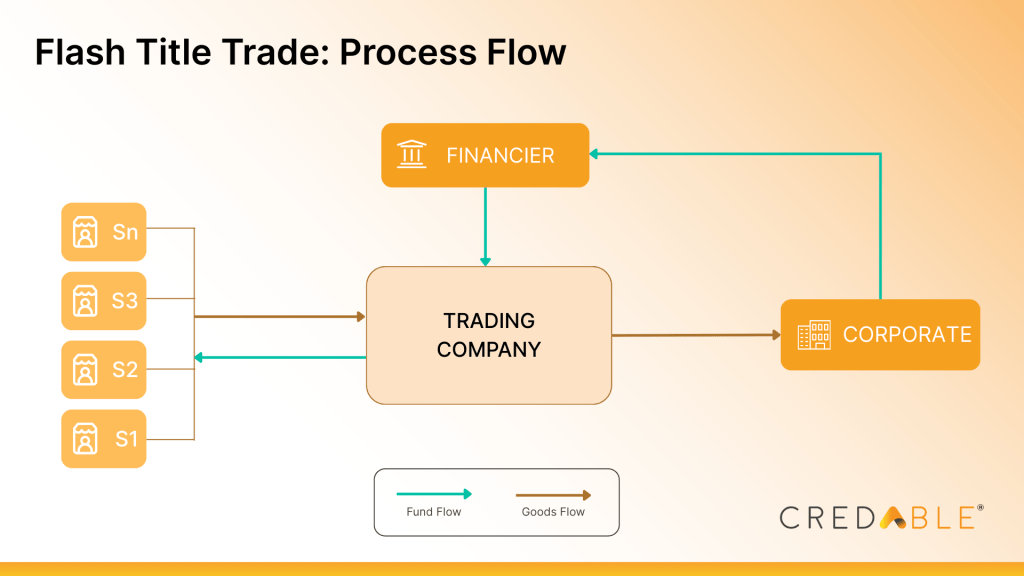

Flash Title Trade works by utilising an intermediary trading company (TradeCo) to consolidate these fragmented suppliers under a single master supplier. Through a back-to-back transfer of ownership, corporates can release liquidity and improve their days payable by extending credit periods for raw materials, ancillary or service procurement. The master supplier structure ensures that suppliers are paid on their due date, avoiding any disruptions in their operations.

This makes flash title trade a flexible and efficient funding mechanism. Their ability to support liquidity without long-term dept makes it a valuable tool. Unlike conventional working capital loans, Structured Trade Solutions by CredAble focus on providing agile, scalable solutions that drive performance and integrating seamless into supply chains and create long term value. CredAble’s strong technological background helps in deploying such solutions at scale without disrupting existing processes.

Explore Structured Trade

Flash Title Trade for Working Capital Efficiency

In many cases, flash title trade is used where suppliers need faster access to payments, but corporates prefer to operate on longer payment terms. By using such procurement aggregation structures, corporates can support supplier payments while deploying a scalable and cost-effective supply chain financing solution. This makes structured trade finance solutions particularly useful in industries such as FMCG, textiles, electronic, chemical and industrial, and across commodities such as agriculture, energy, metals and more.

As businesses look to optimise working capital and maintain supply chain stability, flash title trade offers a practical alternative to conventional trade finance. It supports liquidity, improves cash flow predictability, and aligns financing with real commercial activity.

For companies operating in complex trade environments, Structured Trade Solutions by Credable are becoming an essential part of their working capital strategy. If you wish to explore such structures for your business, connect with the CredAble team.

Frequently Asked Questions About Flash Title Trade

Flash title trade is a structured trade finance mechanism which leverages an intermediary TradeCo to consolidate vendors and extend credit periods for corporates, enhancing their liquidity position and financial metrics.

Through this model of structured trade, corporates can achieve longer credit periods, releasing liquidity for working capital. This improves their days payable outstanding (DPO) and other financial metrics. Additionally, the aggregation of suppliers helps reduce operational effort.

Flash title trade is industry agnostic and can be deployed by any corporate who wishes to extend their credit periods while also enhance their liquidity position.

Companies like CredAble offer structured trade solutions such as flash title trade and this is a widely used and deployed model.

Think Working Capital… Think CredAble!